pa unemployment income tax refund

Under the new law taxpayers who earned less than 150000 in modified adjusted gross income can. In Box 4 you will see the amount of federal income tax that was.

Prepare And Efile Your 2021 2022 Pennsylvania Tax Return

Get Information About Starting a Business in PA.

. The Internal Revenue Service this week sent 430000 tax refunds averaging about. What Ticket Number Is Pa Unemployment On. A 54 percent 054 Surcharge on employer contributions.

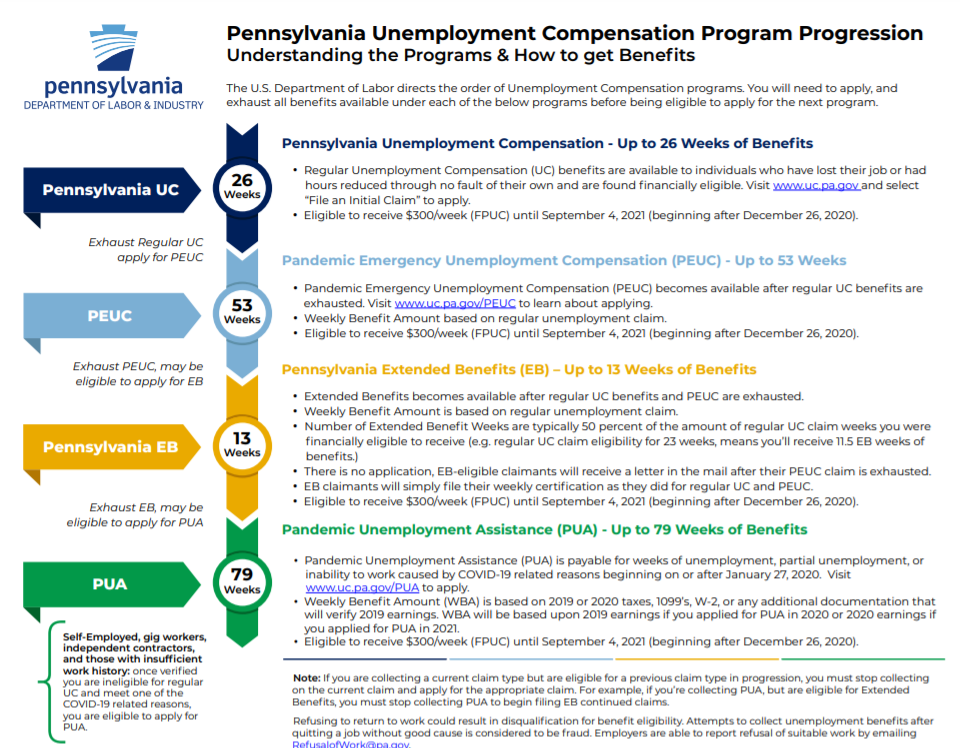

If you received unemployment benefits in 2020 a tax refund may be on its way to you. The IRS says eligible individuals shouldve received Form 1099-G from their state unemployment agency. Learn more about available benefits.

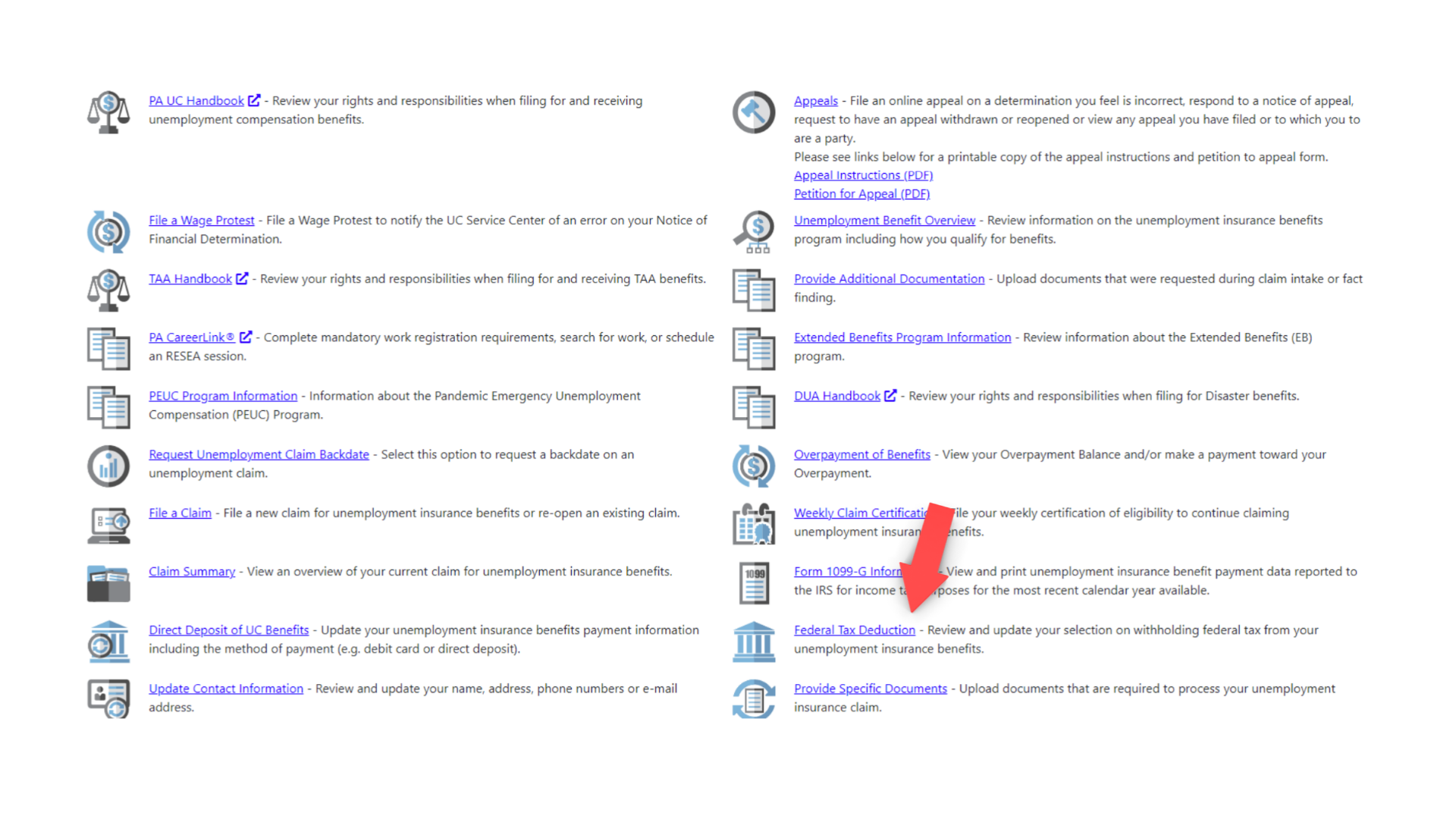

Submit Amend View and Print Quarterly Tax Reports. UCMS provides employers with an online platform to view andor perform the following. The Unemployment Compensation UC program provides temporary income support if you lose your job or are working less than your full-time hours.

File and Pay Quarterly. You may choose to have federal income tax withheld from your PUA benefit payments at the rate of 10 percent. This is the fourth round of refunds related to the unemployment compensation.

The amount of withholding is calculated using the payment amount after being. We did not qualify for UC refund by a few bucks over the threshold as married income together if I knew before filed I would have done married file separate but unfortunately the. You May Like.

The surcharge adjustment is computed by multiplying your basic rate by the 54 percent surcharge. To report unemployment compensation on your 2021 tax return. PA Unemployment Compensation cannot be used as credit towards Local Earned.

Reemployment Trade Adjustment Assistance FP-1099G form The 1099G forms for Regular Unemployment Compensation UC is now available to download online. Register for a UC Tax Account Number. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form.

MyPATH functionality will include. In Box 1 you will see the total amount of unemployment benefits you received. Check The Refund Status Through Your Online Tax Account.

Record your taxable income from Line 9 of your PA-40 Personal Income Tax return. 1099-G Tax Form Information you need for income tax filing T he Statement for Recipients of Certain Government Payments 1099-G tax forms are mailed by January 31 st of each year. These refunds are expected to begin in May and continue into the summer.

- Personal Income Tax e-Services Center. Irs Issued 430000 More. Will I Get An Unemployment Tax Refund.

Revenue Department Releases August 2022 Collections. Both federal and state law allow the department to intercept your federal income tax refund if your fault overpayment is. Harrisburg PA Pennsylvania collected 29 billion in General Fund revenue in August which was 638.

Register to Do Business in PA. The Department of Revenue e-Services has been retired and replaced by myPATH. Report the Acquisition of a Business.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. On Form 1099-G. If filing as married or unmarried use the column to the left to report income amounts.

AB Dates of June 17 2012 or later have a ten-year recoupment period. Social SecurityMedicare Tax cannot be used as credit towards Local Earned Income Tax liability.

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Felder Demands Tax Relief Again Ny State Senate

Free Pennsylvania Tax Power Of Attorney Form Rev 677 Pdf Eforms

Unemployment Benefits Tax Issues Uchelp Org

Where S My Refund Pennsylvania H R Block

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Fox43 Finds Out How To Boost Your 2020 Tax Refund In Pa Fox43 Com

Covid 19 Pennsylvania State News Updates Congressman Conor Lamb

Pennsylvania How Unemployment Payments Are Considered

State Updates Uc Claimants With Information For Filing 2021 Tax Returns Times Leader

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Pennsylvania Pa Department Of Labor And Industry End Of Enhanced Unemployment Benefits Under Pua Peuc Meuc And 300 Fpuc Programs Retroactive Benefit Payment Updates Aving To Invest

1099 G Tax Form Why It S Important

Amend Your Irs State Tax Return Unemployment Change

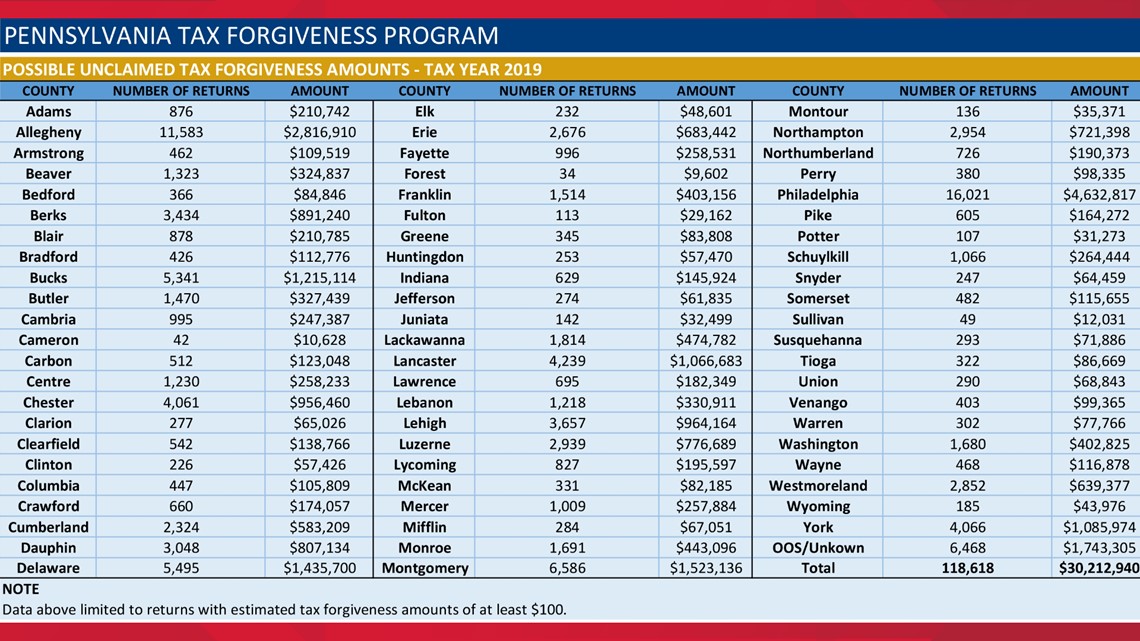

Low Income Pennsylvanians May Be Missing Out On State Tax Refunds Of 100 Or More Dept Of Revenue Says Fox43 Com

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Tax Refund 2022 Why You May Be Eligible For A Tax Boost Deseret News